How to Build a Secure P2P Payment App: Step-by-Step Guide for 2025

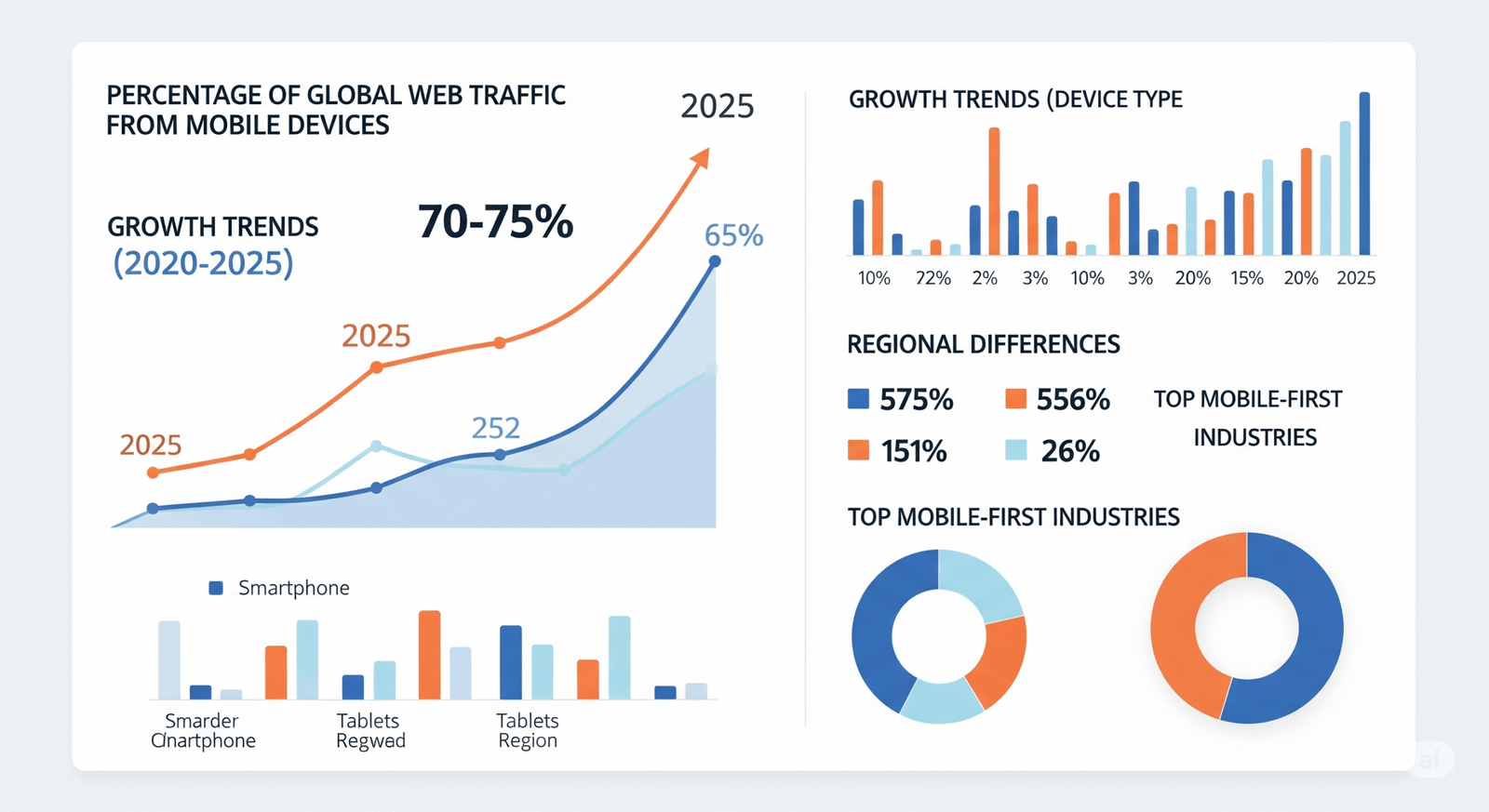

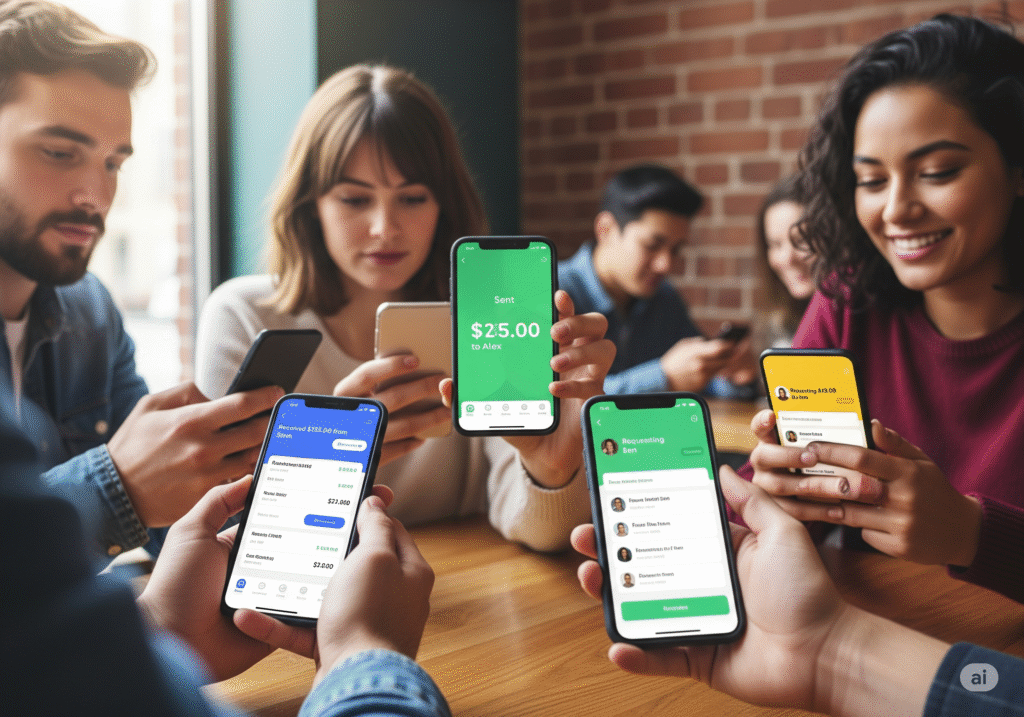

The digital payment revolution has fundamentally transformed how we transfer money, with P2P payment app solutions leading this transformation. From splitting dinner bills to paying rent, peer-to-peer payment applications have become an indispensable part of our daily financial transactions. The global P2P payments market is projected to reach $7.2 trillion by 2027, making it one of the most lucrative sectors for app development.

Building a successful P2P payment app requires more than just connecting users for money transfers. It demands robust security measures, seamless user experience, regulatory compliance, and cutting-edge technology integration. Whether you’re a startup entrepreneur or an established business looking to enter the fintech space, understanding the complete development process is crucial for creating a competitive P2P payment app.

In this comprehensive guide, I’ll walk you through every step of building a secure P2P payment app, from initial planning to deployment and beyond. You’ll discover the essential features, security protocols, technology stack choices, and regulatory requirements that make successful P2P payment applications thrive in today’s competitive market.

Table of Contents

Understanding P2P Payment Apps

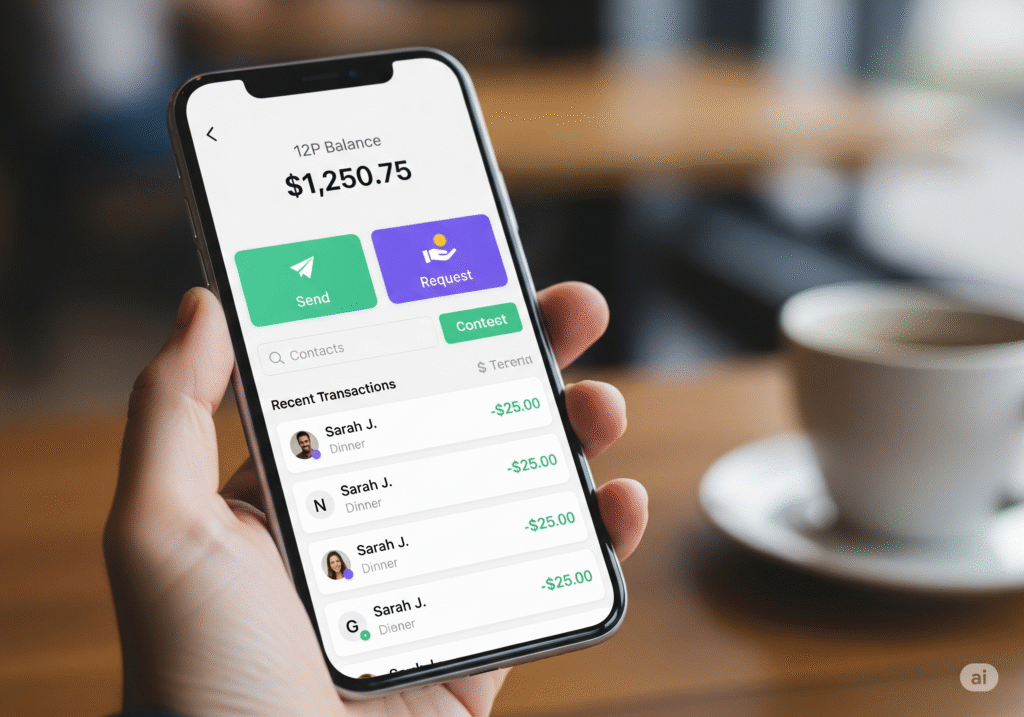

A P2P payment app enables users to transfer money directly from one person to another using mobile devices or web platforms. Unlike traditional banking transfers that require account numbers and routing codes, these applications simplify transactions through phone numbers, email addresses, or usernames.

Key Characteristics of Modern P2P Payment Apps:

- Instant Transfers: Real-time money movement between users

- Multiple Payment Methods: Support for bank accounts, debit cards, and digital wallets

- Social Integration: Built-in contact lists and social features

- Cross-Platform Compatibility: Available on iOS, Android, and web platforms

- Security First: Advanced encryption and fraud prevention measures

The success of applications like Venmo, PayPal, Cash App, and Zelle demonstrates the massive potential in the P2P payment app market. These platforms have redefined how people think about money transfers, making them as simple as sending a text message.

Market Analysis and Opportunities

The P2P payment app market presents unprecedented opportunities for developers and entrepreneurs. Current market data reveals several compelling trends:

| Market Segment | 2024 Value | 2027 Projection | Growth Rate |

|---|---|---|---|

| Global P2P Payments | $4.2 trillion | $7.2 trillion | 19.4% CAGR |

| Mobile P2P Users | 2.8 billion | 4.2 billion | 14.2% CAGR |

| Digital Wallet Adoption | 63% | 84% | 10.1% annually |

| Cross-border P2P | $180 billion | $340 billion | 23.6% CAGR |

Emerging Opportunities for P2P Payment Apps:

- Cryptocurrency Integration: Growing demand for crypto-to-fiat transfers

- International Remittances: Cross-border payment solutions for immigrants

- Business-to-Consumer: Small business payment acceptance

- Social Commerce: Integration with social media platforms

- IoT Payments: Connected device payment capabilities

The competitive landscape includes established players like PayPal and Venmo, but there’s still significant room for innovative P2P payment app solutions that address specific market niches or geographical regions.

Essential Features for P2P Payment Apps

Creating a successful P2P payment app requires implementing both core functionality and advanced features that differentiate your solution from competitors.

Core Features

User Registration and Verification:

- Multi-factor authentication (MFA)

- Identity verification using government IDs

- Phone number and email verification

- Biometric authentication (fingerprint, face recognition)

Payment Processing:

- Instant bank-to-bank transfers

- Debit and credit card integration

- Digital wallet connectivity

- QR code payments

- Voice-activated transactions

Contact Management:

- Phone book integration

- Social media friend discovery

- Custom contact lists

- Payment history tracking

Transaction Management:

- Real-time transaction notifications

- Payment scheduling and recurring transfers

- Transaction categorization and tagging

- Detailed payment history and reporting

Advanced Features

Security and Fraud Prevention:

- AI-powered fraud detection

- Device fingerprinting

- Geolocation verification

- Transaction limits and controls

- Account monitoring and alerts

Social and Communication:

- Payment comments and emojis

- Social feeds for public transactions

- Group payment splitting

- Payment requests and reminders

- In-app messaging

Financial Management:

- Spending analytics and insights

- Budget tracking and alerts

- Integration with personal finance tools

- Investment and savings features

- Cashback and rewards programs

Security Requirements and Compliance

Security forms the foundation of any successful P2P payment app. Users entrust these applications with their most sensitive financial information, making robust security measures non-negotiable.

Essential Security Measures

Data Encryption:

- End-to-end encryption for all communications

- AES-256 encryption for stored data

- TLS 1.3 for data transmission

- Tokenization for sensitive payment information

Authentication and Authorization:

- Multi-factor authentication (MFA)

- Biometric authentication integration

- OAuth 2.0 for secure API access

- JSON Web Tokens (JWT) for session management

Fraud Prevention:

- Machine learning-based fraud detection

- Real-time transaction monitoring

- Device fingerprinting and behavior analysis

- Geolocation and velocity checks

Regulatory Compliance

Financial Regulations:

- PCI DSS compliance for payment processing

- PSD2 compliance for European markets

- BSA/AML compliance for anti-money laundering

- GDPR compliance for data protection

Regional Requirements:

- FinCEN registration in the United States

- FCA authorization in the United Kingdom

- Reserve Bank regulations in India

- Local banking regulations by country

According to the Federal Reserve’s latest payment system report, regulatory compliance is becoming increasingly stringent for P2P payment app providers, making early compliance planning essential.

Technology Stack Selection

Choosing the right technology stack significantly impacts your P2P payment app‘s performance, scalability, and security. Here’s my recommended approach for different components:

Frontend Development

Mobile Applications:

- Native iOS: Swift for optimal performance and iOS-specific features

- Native Android: Kotlin for modern Android development

- Cross-Platform: React Native or Flutter for code reusability

Web Application:

- Frontend Framework: React.js or Vue.js for responsive interfaces

- State Management: Redux or Vuex for complex state handling

- UI Components: Material-UI or Ant Design for consistent design

Backend Development

Server-Side Technology:

- Node.js: Excellent for real-time features and JavaScript consistency

- Python Django/FastAPI: Robust security features and rapid development

- Java Spring Boot: Enterprise-grade reliability and scalability

- Go: High performance for concurrent transaction processing

Database Solutions:

- Primary Database: PostgreSQL for ACID compliance and reliability

- Cache Layer: Redis for session management and real-time data

- Analytics: MongoDB for user behavior and transaction analytics

Payment Processing Integration

Payment Gateways:

- Stripe for comprehensive payment processing

- PayPal for international coverage

- Square for small business integration

- Plaid for bank account connectivity

Banking APIs:

- Open Banking APIs for direct bank integration

- ACH networks for domestic transfers

- SWIFT for international transactions

- Cryptocurrency APIs for digital asset support

Step-by-Step Development Process

Building a P2P payment app requires a systematic approach that ensures security, compliance, and user satisfaction at every stage.

Phase 1: Planning and Research (4-6 weeks)

Market Research and Analysis:

- Competitor analysis and feature comparison

- Target audience identification and user personas

- Regulatory requirements research

- Technology stack evaluation

Business Requirements Documentation:

- Core feature specifications

- Security and compliance requirements

- Integration requirements with banks and payment processors

- Scalability and performance targets

Technical Architecture Design:

- System architecture and component design

- Database schema and data flow diagrams

- API design and integration specifications

- Security architecture and threat modeling

Phase 2: MVP Development (12-16 weeks)

Core Feature Implementation:

- User registration and authentication system

- Basic payment processing functionality

- Contact management and user discovery

- Transaction history and reporting

Security Implementation:

- Encryption and secure communication

- Authentication and authorization systems

- Basic fraud detection mechanisms

- Compliance framework integration

Testing and Validation:

- Unit testing for individual components

- Integration testing for payment flows

- Security testing and vulnerability assessment

- User acceptance testing with beta users

Phase 3: Advanced Features (8-12 weeks)

Enhanced Functionality:

- Social features and payment feeds

- Advanced analytics and reporting

- Group payments and bill splitting

- International transfer capabilities

Performance Optimization:

- Database query optimization

- Caching implementation

- Load balancing and scaling

- Real-time processing improvements

Advanced Security:

- Machine learning fraud detection

- Advanced authentication methods

- Compliance automation tools

- Security monitoring and alerting

Phase 4: Polish and Launch Preparation (6-8 weeks)

User Experience Refinement:

- UI/UX improvements based on user feedback

- Performance optimization and bug fixes

- Accessibility improvements

- Multi-language support implementation

Launch Preparation:

- App store optimization and submission

- Marketing material preparation

- Customer support system setup

- Launch strategy execution

UI/UX Design Best Practices

The success of a P2P payment app heavily depends on its user interface and experience design. Financial applications require a perfect balance between functionality and simplicity.

Design Principles for P2P Payment Apps

Simplicity and Clarity:

- Minimize the number of steps for common tasks

- Use clear, action-oriented language

- Implement intuitive navigation patterns

- Provide immediate feedback for user actions

Trust and Security Visualization:

- Display security badges and certifications

- Show real-time transaction status updates

- Implement clear error messages and recovery paths

- Use consistent visual language for security features

Accessibility and Inclusion:

- Support for screen readers and assistive technologies

- High contrast modes for visually impaired users

- Large touch targets for motor accessibility

- Multiple language support for diverse users

Key Design Elements

Onboarding Experience:

- Progressive disclosure of features and benefits

- Step-by-step account setup with clear progress indicators

- Educational content about security and privacy

- Quick access to customer support during setup

Payment Flow Design:

- One-tap payment for frequent contacts

- Visual confirmation before transaction completion

- Real-time balance updates and transaction status

- Easy access to transaction history and details

Dashboard and Analytics:

- Clean, scannable transaction history

- Visual spending analytics and insights

- Quick access to frequently used features

- Personalized recommendations and tips

Testing and Quality Assurance

Comprehensive testing is crucial for P2P payment app development, given the critical nature of financial transactions and user data protection.

Testing Strategy

Functional Testing:

- Payment processing accuracy and reliability

- User authentication and authorization flows

- Integration testing with banking APIs

- Cross-platform compatibility verification

Security Testing:

- Penetration testing and vulnerability assessments

- Data encryption and transmission security

- Authentication bypass attempts

- SQL injection and XSS vulnerability testing

Performance Testing:

- Load testing for concurrent user scenarios

- Stress testing for peak transaction volumes

- Database performance under heavy loads

- API response time optimization

Compliance Testing:

- PCI DSS compliance verification

- Regulatory requirement validation

- Data privacy and protection testing

- Audit trail and reporting accuracy

Quality Assurance Process

Automated Testing:

- Unit tests for individual components

- Integration tests for payment flows

- Continuous integration and deployment pipelines

- Automated security scanning tools

Manual Testing:

- User experience testing across devices

- Edge case scenario validation

- Accessibility testing with assistive technologies

- Real-world usage simulation

Deployment and Launch Strategy

Successfully launching a P2P payment app requires careful planning and execution across multiple channels and platforms.

Pre-Launch Preparation

Regulatory Approval:

- Submit applications for required licenses

- Complete compliance audits and certifications

- Establish relationships with banking partners

- Implement required reporting and monitoring systems

Infrastructure Setup:

- Production environment deployment

- Monitoring and alerting system configuration

- Backup and disaster recovery implementation

- Customer support system activation

Marketing and Communications:

- App store optimization for discovery

- Content marketing and educational resources

- Social media presence establishment

- Press release and media outreach preparation

Launch Execution

Soft Launch Strategy:

- Limited geographic or user base rollout

- Beta testing with selected user groups

- Performance monitoring and optimization

- User feedback collection and implementation

Full Launch Approach:

- Coordinated marketing campaign across channels

- Customer support team scaling

- Performance monitoring and rapid response

- User acquisition and retention tracking

Mobile App Branding is done perfectly by YAAM Web Solutions, ensuring your P2P payment app stands out in crowded app stores with compelling visual identity and user experience design.

Monetization Strategies

Developing sustainable revenue streams is essential for long-term P2P payment app success. Here are the most effective monetization approaches:

Primary Revenue Models

Transaction Fees:

- Percentage-based fees on transactions

- Flat fees for specific transaction types

- Premium fees for instant transfers

- International transfer commissions

Subscription Services:

- Premium features and enhanced limits

- Advanced analytics and reporting

- Priority customer support

- Business account features

Interchange Revenue:

- Debit card transaction revenue sharing

- Credit card processing fees

- Merchant payment processing

- ATM network partnerships

Secondary Revenue Streams

Financial Services:

- Investment and savings account integration

- Loan and credit product referrals

- Insurance product partnerships

- Cryptocurrency trading features

Data and Analytics:

- Anonymized spending insights for merchants

- Market research and trend analysis

- Targeted advertising opportunities

- Business intelligence services

Post-Launch Maintenance and Updates

Continuous improvement and maintenance are crucial for P2P payment app success in the competitive fintech market.

Ongoing Development Priorities

Security Updates:

- Regular security patches and updates

- Threat monitoring and response

- Compliance requirement adaptations

- Fraud detection algorithm improvements

Feature Enhancement:

- User-requested feature implementation

- Performance optimization and bug fixes

- Integration with new payment methods

- Advanced analytics and reporting tools

User Experience Improvements:

- Interface updates based on user feedback

- Accessibility enhancements

- Localization for new markets

- Customer support improvements

Maintenance Best Practices

Monitoring and Analytics:

- Real-time performance monitoring

- User behavior and engagement tracking

- Transaction success rate monitoring

- Security incident detection and response

User Feedback Integration:

- Regular user surveys and feedback collection

- App store review analysis and response

- Customer support ticket analysis

- Beta testing program management

Cost Analysis and Budget Planning

Understanding the complete cost structure is essential for successful P2P payment app development and launch.

Development Costs

| Development Phase | Estimated Cost Range | Timeline |

|---|---|---|

| Planning & Research | $15,000 – $30,000 | 4-6 weeks |

| MVP Development | $80,000 – $150,000 | 12-16 weeks |

| Advanced Features | $50,000 – $100,000 | 8-12 weeks |

| Testing & QA | $20,000 – $40,000 | 4-6 weeks |

| Total Development | $165,000 – $320,000 | 6-9 months |

Operational Costs

Infrastructure and Hosting:

- Cloud hosting: $2,000 – $10,000/month

- Database services: $1,000 – $5,000/month

- CDN and security services: $500 – $2,000/month

- Monitoring and analytics: $300 – $1,000/month

Compliance and Security:

- PCI DSS compliance: $10,000 – $50,000 annually

- Security audits: $15,000 – $30,000 annually

- Legal and regulatory: $20,000 – $50,000 annually

- Insurance and bonding: $10,000 – $25,000 annually

Payment Processing:

- Transaction fees: 1.5% – 3.5% per transaction

- Banking integration: $10,000 – $50,000 setup

- Fraud prevention: $0.05 – $0.15 per transaction

- Chargeback protection: $0.50 – $2.00 per dispute

Common Challenges and Solutions

Building a P2P payment app involves overcoming several technical, regulatory, and business challenges.

Technical Challenges

Scalability and Performance:

- Challenge: Handling high transaction volumes and concurrent users

- Solution: Implement microservices architecture, database sharding, and caching layers

Security and Fraud Prevention:

- Challenge: Protecting against sophisticated fraud attempts

- Solution: Machine learning fraud detection, behavioral analysis, and real-time monitoring

Integration Complexity:

- Challenge: Connecting with multiple banks and payment processors

- Solution: Standardized API integration, webhook management, and failover systems

Regulatory Challenges

Compliance Management:

- Challenge: Navigating complex and changing regulatory requirements

- Solution: Partner with compliance experts, implement automated reporting, and maintain current legal counsel

International Expansion:

- Challenge: Meeting different regulatory requirements in multiple countries

- Solution: Phased expansion approach, local partnerships, and regulatory consultants

Business Challenges

User Acquisition:

- Challenge: Competing with established players for market share

- Solution: Targeted marketing, unique value propositions, and strategic partnerships

Revenue Generation:

- Challenge: Balancing user growth with monetization

- Solution: Freemium models, value-added services, and gradual fee introduction

Future Trends in P2P Payments

The P2P payment app landscape continues evolving with emerging technologies and changing user expectations.

Emerging Technologies

Artificial Intelligence and Machine Learning:

- Predictive analytics for user behavior

- Advanced fraud detection and prevention

- Personalized financial recommendations

- Automated customer support

Blockchain and Cryptocurrency:

- Decentralized payment networks

- Cryptocurrency integration and conversion

- Smart contracts for automated payments

- Cross-border payment optimization

Internet of Things (IoT):

- Connected device payment capabilities

- Wearable device integration

- Smart home payment automation

- Vehicle-based payment systems

Market Evolution

Open Banking:

- Direct bank account integration

- Enhanced financial data access

- Improved user experience

- Reduced transaction costs

Super App Integration:

- Multi-service platform development

- E-commerce and payment convergence

- Social media payment integration

- Lifestyle service bundling

Conclusion

Building a secure P2P payment app requires careful planning, robust security implementation, and continuous innovation. The market opportunities are substantial, but success demands attention to user experience, regulatory compliance, and security best practices.

The key to developing a successful P2P payment app lies in understanding your target market, implementing comprehensive security measures, and creating a seamless user experience that builds trust and encourages adoption. While the initial investment is significant, the potential returns in this growing market make it an attractive opportunity for entrepreneurs and established businesses alike.

As the digital payment landscape continues evolving, staying ahead of technological trends and regulatory changes will be crucial for long-term success. Whether you’re building your first fintech application or expanding an existing platform, following the step-by-step approach outlined in this guide will help you create a competitive P2P payment app that meets user needs and regulatory requirements.

For businesses ready to enter the P2P payment market, partnering with experienced development teams becomes essential. YAAM Web Solutions specializes in fintech application development, offering comprehensive services from initial planning through post-launch support, ensuring your P2P payment app meets the highest standards of security, performance, and user experience.

Founded in 2018, YAAM Web Solutions is a trusted tech company delivering ISO 27001-certified digital solutions and innovative fintech application development services.

Frequently Asked Questions

1. How much does it cost to build a P2P payment app?

The cost of developing a P2P payment app typically ranges from $165,000 to $320,000 for a complete solution, depending on feature complexity and development approach. This includes MVP development, advanced features, security implementation, and testing. Ongoing operational costs including compliance, security, and infrastructure can range from $50,000 to $150,000 annually.

2. How long does it take to develop a P2P payment app?

A complete P2P payment app development process typically takes 6-9 months from initial planning to launch. This includes 4-6 weeks for planning and research, 12-16 weeks for MVP development, 8-12 weeks for advanced features, and 6-8 weeks for testing and launch preparation. Timeline can vary based on feature complexity and regulatory requirements.

3. What are the essential security features for a P2P payment app?

Essential security features for a P2P payment app include end-to-end encryption, multi-factor authentication, biometric verification, real-time fraud detection, device fingerprinting, and secure API integration. Additionally, PCI DSS compliance, regular security audits, and continuous monitoring are crucial for maintaining user trust and regulatory compliance.

4. Which technology stack is best for P2P payment app development?

The best technology stack for a P2P payment app includes React Native or Flutter for cross-platform mobile development, Node.js or Python for backend services, PostgreSQL for primary database, Redis for caching, and cloud infrastructure like AWS or Google Cloud. Payment integration requires APIs from Stripe, PayPal, or direct banking partnerships through Plaid or similar services.

5. How do P2P payment apps make money?

P2P payment apps generate revenue through multiple streams including transaction fees (typically 1-3% per transaction), subscription services for premium features, interchange fees from card transactions, and financial service partnerships. Additional revenue comes from business accounts, international transfer fees, and value-added services like investment and savings products.